Beef Market Research Report in Ukraine and MENA Region. 2018

| Date of Preparation: | June 2018 year |

| Number of pages: | 36 |

| Graphs and charts: | 29 |

| Tables: | 23 |

| Payment method: | prepayment |

| Production method: | e-mail or courier electronically or in printed form |

| Report language: | English |

- This report can be updated and customized based on your business goals; you can also purchase part of report (no less than 50%) at a more affordable price

- Failed to find your market research report? - contact us

- You can also order feasibility study and business plan for your business idea

Summary of the market analysis:

Pro-Consulting conducted a study of the Ukrainian beef market and the possibility of exporting products to the countries of the MENA region. The market survey analyzes current state of the beef industry in Ukraine, as well as the potential of importing countries in the Middle East and North Africa.

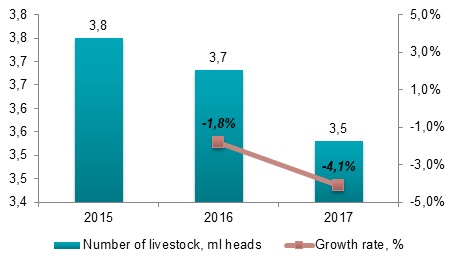

The beef production sector in Ukraine has recently experienced a negative impact of economic factors, which made cattle breeding financially unprofitable, and the price of the final product - too high for consumers. The payback period of investments in a full cycle business can reach 10 years, which causes a lot of risks. All this led to a reduction in the number of cattle and a reduction in the share of beef in the Ukrainian consumer market in favor of chicken and pork. Thus, beef now has the weakest positions among the main types of meat, production figures are declining year after year. The corresponding increase in prices further limits domestic consumption.

Cattle livestock in Ukraine in 2015-2017, ml heads

Source: State statistics service of Ukraine; Pro-Consulting assessment

A promising trend for beef producers is export development. In the foreign market, in particular, the Middle East and North Africa, Ukrainian producers have several advantages: cattle feeds in Ukraine are relatively cheap, and delivery of beef is easier than for the main exporting countries - Brazil, India, Australia. The beef export direction is encouraged by governmental and non-governmental initiatives (like FAO). Thus, last year exports grew due to the launch of supplies to China.

Among the potential geographic areas of export, the Middle East and North Africa (MENA) are highlighted as a region with a high demand for halal meat. MENA is a region with a growing population and average per capita income. It is home to more than 450 million people, the most populated countries are Egypt, Iran and Algeria. The average income is growing, but it differs significantly from country to country. Revenues of rich Gulf countries with large oil reserves are strikingly different from countries with scarce resources such as Egypt, Morocco and Yemen, where a large number of people live in poverty.

It is expected that the population and the average income in the MENA region will grow in the next 10 years. The stabilization of oil prices at a rather high level, the recovery of the economy on the background of reducing conflicts causes positive projections of economic growth. The World Bank declares 3.1-3.3% growth in 2018-2020.

In spite of the difficult climatic conditions, the countries of MENA produce almost 2 million tons of beef. However, the growing demand caused by urbanization, the spread of Western lifestyle among the young population, low expected inflation and tourism, increases the need for beef imports. Imported products must meet local food requirements, in particular, to have a halal certificate.

At the same time, there are many risks associated with oil and gas prices, as well as political instability. These factors have a significant effect on foreign trade and demand for imported goods.

Detailed contents:

1. Overview of the market

1.1. Market trends in 2015-2017 (history, specific problems, factors of influence)

1.2. General market indicators, market size in 2015-2017

1.3. Segmentation and market structuring

2. Government regulation (state dotation, taxes, import & export duties)

3. Production in 2015-2017

3.1. Production in natural indexes in 2015-2017 (Ukraine and MENA)

3.2. Production value in 2015-2017 (Ukraine and MENA)

4. Major market players

4.1. Main companies and their description (export-oriented in Ukraine)

4.2. Segmentation and structuring of the main operators (by segments, groups, other activity and region)

4.3. Shares of major market operators (Ukrainian producers)

5. Foreign trade on the market

5.1. Exports of production in Ukraine and MENA region in 2015-2017 (volume, structure, geography of supply by the countries, major exporters (Ukraine))

5.2. Imports of production in 2015-2017 (volume, structure, geography of supply by the countries, major importers)

6. Price and pricing on the market

6.1. Prices in 2015-2017 (retail, wholesale, import, export) – prices in Ukraine and MENA region countries

7. Meat consumption on the MENA market (by countries)

8. Conclusions and recommendations. Expected indicators of market development in 2018-2020

8.1. Conclusions and forecasts of market development

8.2. Construction of market development hypotheses. Projected market development indicators

8.3. Recommendations for the development on the market

9. Investment attractiveness of the market

9.1. SWOT-analysis for export-oriented production

9.2. Existing risks and obstacles in entering the market

9.2.1. Risk map of the market (exports)

List of Tables:

1. Cattle livestock structure in Ukraine in 2017, thous. heads

2. General market indicators in natural indexes in 2015-2017 in Ukraine, thousand tones

3. General market indicators in natural indexes in 2015-2017 in MENA region, thousand tones

4. Rating of the regions of Ukraine by the total amount of animals in all types of farms on 1Q 2018

5. Distribution by the aims of usage in according to State program on 2018

6. Import custom duties on livestock and beef in Ukraine since 2017

7. Export duties on livestock in Ukraine since 2018

8. List of the Halal certification centers in Ukraine

9. Current import custom duties on livestock and beef in MENA countries since 2018

10. Production of cattle meat (both fresh and frozen) in selected MENA countries in 2015-2017, in natural indexes, thousand tones

11. List of the main beef-producing companies in Ukraine in 2017

12. Segmentation of the main operators on the Ukrainian beef market

13. Market shares of the Ukrainian beef producers in the segment of fresh meat in 2016

14. Market shares of the Ukrainian beef producers in the segment of frozen meat in 2016

15. Exports of cattle meat (both fresh and frozen) by exporting company in natural indexes in 2017. thousand tones

16. Imports of cattle meat (both fresh and frozen) by importing company in natural indexes in 2017. tons

17. Beef price dynamic in the MENA region by the destination and type of product in 2015-2017, $ per kg

18. Cattle meat consumption (both fresh and frozen) in MENA region in 2015-2017, by countries, Kg per capita

19. Ukrainian cattle meat export to MENA region in 2015-2017, in natural indexes

20. Calculation of the rating of the most promising MENA countries for the export of beef

21. SWOT-analysis for Ukrainian potential beef exporter

22. Risk zones description

23. Risk map for Ukrainian potential beef exporter

List of graphs and charts:

1. Meat production by types in Ukraine in 2017, in natural indexes, %

2. Cattle livestock in Ukraine in 2015-2017, ml heads

3. Cattle livestock in MENA in 2015-2017, ml heads

4. Cattle livestock structure in MENA by country in 2017, ml heads

5. Structure of the regions of Ukraine by the annual amount of the fresh beef production in 2017, t

6. Structure of the regions of Ukraine by the annual amount of the frozen beef production in 2017, t

7. Beef production structure by the type of technological processing in Ukraine in 2015-2017, t

8. Beef market structure by the origin of meat in the 2015-2017, t

9. Production of cattle meat in Ukraine in 2015-2017, in natural indexes

10. Production of cattle meat (both fresh and frozen) in MENA in 2015-2017, in natural indexes

11. Production of cattle meat in Ukraine in 2015-2017, in money indexes

12. Production of cattle meat (both fresh and frozen) in MENA in 2015-2017, in money indexes

13. Exports of production in Ukraine in 2015-2017, in natural and money indexes

14. Exports structure of cattle meat in Ukraine in 2017, in natural indexes. %

15. Exports of cattle meat (both fresh and frozen) by the country of destination in natural indexes in 2017, %

16. Exports of cattle meat (both fresh and frozen) in MENA in 2015-2017, in natural and money indexes

17. Exports structure of cattle meat in MENA in 2017, in natural indexes. %

18. Exports of cattle meat (both fresh and frozen) by the country MENA in natural indexes in 2017, %

19. Imports of production in Ukraine in 2015-2017, in natural and money indexes

20. Imports structure of cattle meat in Ukraine in 2017, in natural indexes. %

21. Imports of cattle meat (both fresh and frozen) by the country of origin in natural indexes in 2017, %

22. Imports of cattle meat (both fresh and frozen) in MENA in 2015-2017, in natural and money indexes

23. Imports structure of cattle meat in MENA in 2017, in natural indexes. %

24. Imports of cattle meat (both fresh and frozen) in MENA by the country in natural indexes in 2017, %

25. Import price dynamic of fresh and frozen beef in Ukraine in 2015-2017, $/kg

26. Export price dynamic of fresh and frozen beef in Ukraine in 2015-2017, $/kg

27. Producer and retail price dynamic of fresh and frozen beef in Ukraine in 2015-2017, $/kg

28. Cattle meat market size forecast in MENA region in 2018-2020, in natural indexes, thous. tons

29. Cattle meat market size forecast in Ukraine in 2018-2020, in natural indexes, thous. tons