Starter batteries in Mexico market research report. 2018

| Date of Preparation: | April 2018 year |

| Number of pages: | 23, Arial |

| Graphs and charts: | 13 |

| Tables: | 9 |

| Payment method: | prepayment |

| Production method: | e-mail or courier electronically or in printed form |

| Report language: | English |

- This report can be updated and customized based on your business goals; you can also purchase part of report (no less than 50%) at a more affordable price

- Failed to find your market research report? - contact us

- You can also order feasibility study and business plan for your business idea

Summary of the market analysis:

Most starter batteries are lead-acid batteries. They consist of lead plates that are immersed in the electrolyte solution. This solution contains on average 62% water and 38% sulfuric acid. Starter batteries are classified according to the production technology used, distinguishing the following types:

- Serviced battery: open batteries are the most common and characterized by the presence of holes for access to their internal parts with removable plugs.

- Maintenance-free battery (VRLA): A battery in which the evaporation of gases formed during electrolysis of the electrolyte is automatically controlled by a pressure-sensitive valve.

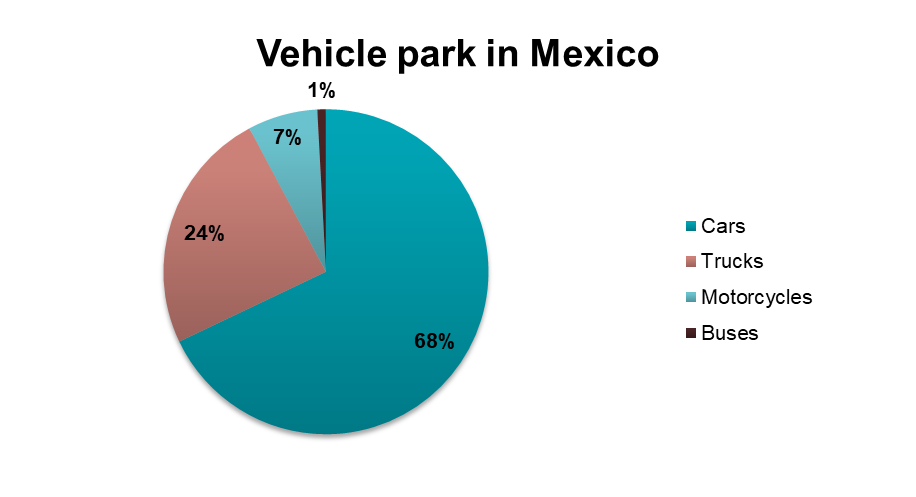

Every year, the number of cars in Mexico is growing rapidly: new factories for the production of cars are opening, and the production of existing plants is gaining momentum. For the years 2016 and 2017, the growth in car production was 10% compared to 2015. Accordingly, the market for starter batteries in Mexico is also developing annually. In the carpark of Mexico predominate cars - 68% and trucks - 24%.

About 75% of the market of starting batteries in Mexico - domestic batteries, the remaining 25% is imported (mainly from the US). Approximately 40% of all manufactured starting batteries in Mexico are exported. Most of the exports also fall to the US. Import of starter batteries to Mexico is growing more intensively than production in Mexico. Therefore, the Mexican market is open to new trading partners.

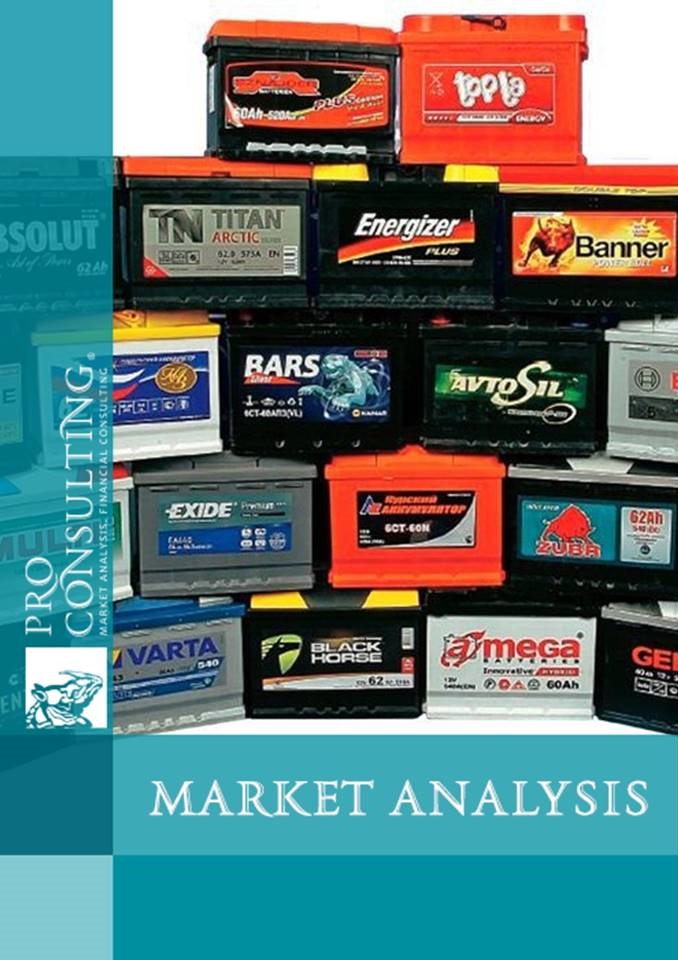

The main company for the production of automotive batteries, both on the Mexican market and throughout the world, is Johnson Controls. This company produces batteries of trademarks: VARTA, LTH, Heliar, MAC, Optima, Delkor, etc. Also common are batteries in the Mexican market of trademarks: America, Cronos, Full Power, Diener. Johnson Controls controls about 75% of the Mexican market for starter batteries.

State regulation of production and utilization of starter batteries in Mexico is quite low. Because of this, the cost of manufactured batteries in Mexico is relatively low at a relatively high level of quality, as companies do not spend large sums on upgrading their equipment in order to reduce waste emissions.

The market for starter batteries in Mexico is quite advanced, but there is still a lot of potential for growth. Annually one battery produced for three existing cars.

Detailed contents:

1. General characteristics of the starter batteries market

1.1. Analysis of market development trends in 2016-2017

Recycling policy for used batteries

Guarantees policy in Mexico

Testing requirements on the border as well certificates needed for Mexico market

1.2. General market indicators, calculation of market capacity in 2016-2017

2. Production dynamics of starter batteries in 2016-2017

2.1. Production in natural indexes in 2016-2017

2.2. Production of money indexes in 2016-2017

3. The main players on the market of starter batteries (including how many large players are there in starter batteries in the Mexico market)

3.1. Main players on the market and their description (are batteries packed in cardboard boxes – photo if information is available)

3.1.1. Huge consumers of starter batteries in Mexico as potential buyers of starter batteries

3.2. Segmentation and structuring of the main market players (types of batteries that are most often purchased, market share respecting to: usage (cars/trucks), electrical parameters; photo documentation, catalogs – if information is available)

3.3. The market share of key players in 2017 – estimation based on free data

4. Foreign trade on the market of starter batteries

4.1. Exports in 2016-2017 (volumes, prices, geography by countries)

4.2. Imports in 2016-2017 (volumes, prices, geography by countries)

5. Price and pricing on the market (Mexican market Battery prices for specific segment of the market: budget / standard /premium / luxury- battery type)

5.1. Product prices in 2016-2017

5.2. Description of factors affecting the formation of prices, structure (market characteristics)

6. Distribution channels on the market (market, networks, workshops)

7. Conclusions and recommendations (including requirements of potential customers, like: deliver time, brand name, warranty)

Projected market development indicators in 2018-2020

8. Investment attractiveness of the industry

8.1. SWOT - analysis of market direction

8.2. Risks and barriers to market entry

List of Tables:

1.1.1. Summary of Mexico and U.S. Lead Standards

1.2.1. Dynamics of the size of the market for starter batteries in Mexico in 2016-2017

3.1.1. Production of cars in Mexico in 2017

5.1.1. Retail prices for starter batteries of major brands in Mexico by segment type, USD

5.1.2. Major brands of starter batteries by segments in Mexico

5.1.3. The dynamics of average retail prices for starter batteries in Mexico in 2016-2018 by type, USD

6.1. List of main distributors with addresses and contact details that operate in Mexico

8.1.1. SWOT-analysis of the market starter batteries in Mexico

8.2.1. Risks and barriers to entry into the market of starter batteries in Mexico

List of graphs and charts:

1.2.1. Dynamics of the size of the market for starter batteries in Mexico in natural indexes in 2016-2017, thous. pcs

2.1.1. Dynamics of production of the market for starter batteries in Mexico in natural indexes in 2016-2017, thous. pcs

2.1.2. Dynamics of production of the market for starter batteries in Mexico in monetary indexes in 2016-2017, mln $

3.1.1. LTH battery in carton

3.1.2. VARTA battery in carton

3.2.1. Structure of the car park of Mexico in 2016,%

4.1.1. Dynamics of export of starter batteries from Mexico in natural indexes in 2016-2017, thous. pcs

4.1.2. Dynamics of exports in terms of countries of destination products in natural indexes in 2016,%

4.2.1. Dynamics of import of starter batteries in Mexico in natural indexes in 2016-2017, thous. pcs

4.2.2. Dynamics of imports by terms of countries of origin in natural indexes in 2016,%

6.1. The structure of sales of auto parts, including car batteries by the types of distribution channels in Mexico in 2017, %

6.2. Scheme of the movement of auto parts from the manufacturer to the buyer

7.1. The forecast of size of the market of starter batteries in Mexico in 2018-2020, thous. pcs