German starter batteries market research report. 2018

| Date of Preparation: | May 2018 year |

| Number of pages: | 32 |

| Graphs and charts: | 28 |

| Tables: | 10 |

| Payment method: | prepayment |

| Production method: | e-mail or courier electronically or in printed form |

| Report language: | English |

- This report can be updated and customized based on your business goals; you can also purchase part of report (no less than 50%) at a more affordable price

- Failed to find your market research report? - contact us

- You can also order feasibility study and business plan for your business idea

Summary of the market analysis:

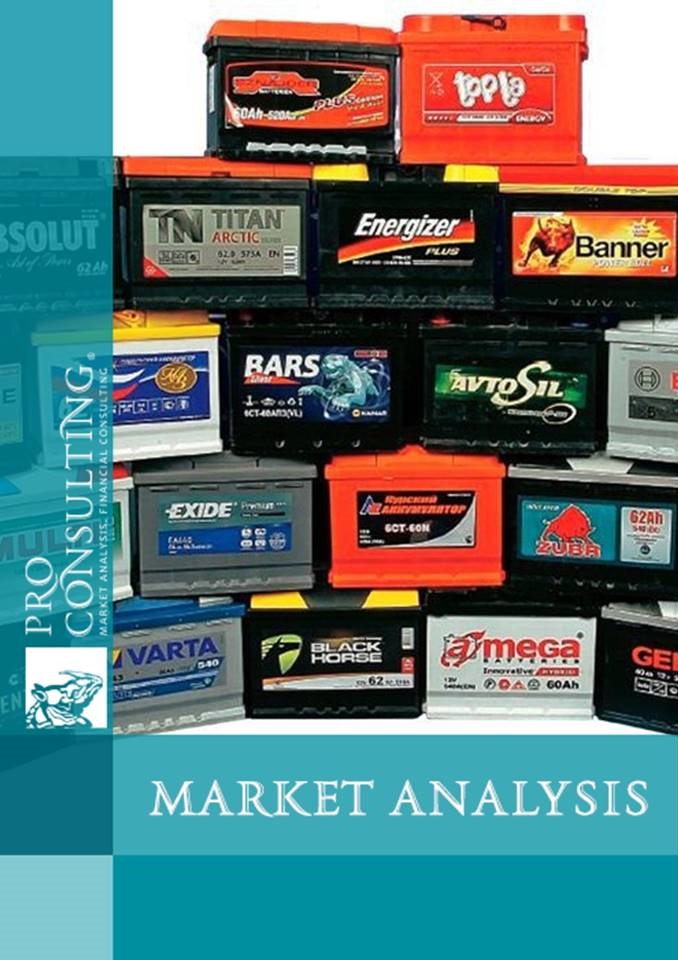

Analysts of Pro-Consulting prepared the deep analysis of the market for Germany's starter car batteries. The project provides information on the state policy regarding the control and disposal of starter batteries, the necessary certificates and permits, and the standards in force in Germany. The capacity of the German domestic market is analyzed, as well as its place in the European and world market of starter batteries. The characteristics of production and the main players in the production sector and distributors in this market are given. Analysis of foreign economic activity allowed to distinguish the structure and volumes of foreign trade in the market. Based on market segmentation and price analysis, forecast values of market development were constructed using econometric models and investment attractiveness was described.

Remaining the leader in Europe in terms of the volume and quality of the produced cars, Germany's battery market is the most developed and large due to its production capacity, as well as high secondary battery recycling rates. In the structure of the European market Germany occupies more than 40%, while on a global scale it accounts for about 13%. In the structure of the volume of recycled batteries, Germany stably ranks first in Europe.

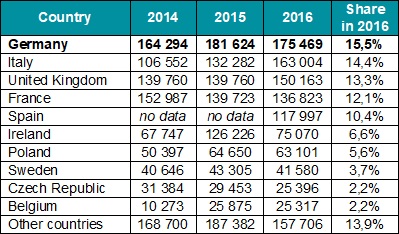

Dynamic of volumes of used batteries and accumulators recycling in countries-participants of EU in 2014-2016, mln. t

Source: Eurostat data; Pro-Consulting assessment

The main indicators of the market show positive dynamics in the period under review. Among major battery manufacturers are large multinational corporations, only a small share of the market belongs to local companies. As in most European markets, Germany has a pattern of orders for production from distributors and large brands of auto parts and car brands at the capacities of key manufacturers, which creates additional demand and increased sales.

The structure of the domestic market is dominated by imported cheaper batteries, while most of the German batteries produced are exported. The largest consumers of German batteries on the foreign market are France, the Czech Republic and the United States, and the Czech Republic, Spain and Austria as importers.

In general, the key drivers of market development are a powerful automotive industry, a large car fleet and financial capabilities of companies. They provide qualitative growth and adaptation of players to new trends and qualitative requirements (an additional new request for batteries among manufacturers of hybrid electric power plants, start-stop systems, commercial segment, etc.). One of the weaknesses is expensive labor, and the moral obsolescence of products. As it was said before - the need to adapt to new market demands makes the market of traditional lead-acid batteries obsolete, and the high cost of production, also caused by high wages of workers, does not allow successfully compete with cheaper imported batteries.

Detailed contents:

1. General characteristics of the starter batteries market

1.1. Analysis of market development trends in 2016-2017 (including recycling policy for used battery; guarantees policy in Germany; testing requirements on the border as well certificates needed for German market)

1.2. General market indicators, calculation of market capacity in 2016-2017

2. Production dynamics of starter batteries in 2016-2017

2.1. Production in natural indexes in 2016-2017

2.2. Production of money indexes in 2016-2017

3. The main players on the market of starter batteries (including how many large players are there in starter batteries in the Germany market)

3.1. Main players on the market and their description (are batteries packed in cardboard boxes – foto if information is available)

3.1.1. Huge consumers of starter batteries in Germany as potential buyers of starter batteries

3.2. Segmentation and structuring of the main market players (types of batteries that are most often purchased, market share respecting to: usage (cars/trucks), electrical parameters; photo documentation, catalogs – if information is available)

3.3 The market shares of key players in 2017 – estimation based on free data

4. Foreign trade on the market of starter batteries

4.1. Exports in 2016-2017 (volumes, prices, geography by countries)

4.2. Imports in 2016-2017 (volumes, prices, geography by countries)

5. Price and pricing on the market (German market Battery prices for specific segment of the market: budget / standard /premium / luxury- battery type)

5.1. Product prices in 2016-2017

5.2. Description of factors affecting the formation of prices, structure (market characteristics)

6. Distribution channels on the market (market, networks, workshops)

7. Conclusions and recommendations (including requirements of potential customers, like: deliver time, brand name, warranty)

Projected market development indicators in 2018-2020

8. Investment attractiveness of the industry

8.1. SWOT - analysis of market direction

8.2. Risks and barriers to market entry

List of Tables:

1. Dynamic of volumes of used batteries and accumulators recycling in countries-participants of EU in 2014-2016, mln. t

2. The list of European countries by the SLI battery aftermarket volumes in 2016

3. Description of the German starter batteries market main players

4. List of the main non-manufacturing players on German starter battery market

5. The top-selling car brands in Germany in 2016-2017 according to new passenger vehicle registration data released by the KBA, pcs

6. The list of the most popular German brands according to the price segments

7. The average product prices by brand and by price segment in per one battery in 2018

8. Matrix variable factor correlation of the model, correlation index ρxy

9. SWOT-analysis for the German starter battery market

10. List of the risks, that impact on the German starter battery market

List of graphs and charts:

1. Market size share of Germany in the world market size and in the EMEA region in 2016, mln. pcs

2. Market size dynamic of starter batteries in Germany in 2016-2017, mln. pcs

3. Market size dynamic of starter batteries in Germany in 2016-2017, $ mln.

4. Dynamic of country of origin structure on the German starter batteries market in 2016-2017, mln. pcs

5. Dynamic of structure by way of destination on the German market of starter batteries in 2016-2017, mln. pcs

6. Production dynamic of starter batteries in Germany in 2016-2017 in natural indexes, mln. pcs

7. Production value of German starter batteries market in 2016-2017 in monetary indexes, $ mln.

8. Sales dynamic of commercial vehicles from 2013 to 2017, thousand units

9. Structure of the motor vehicle park of Germany in 2017, %

10. Motor vehicles sales dynamic by type of carriage body through 2016-2017, in %

11. Structure of European starter battery market by the type of technology in 2011-2017, in mln. units

12. Interview results about which brand is more frequently bought among the German car owners, in percentage of total answers of respondents

13. Structure of market shares of key players on the starter battery market in 2017, mln. pcs produced

14. Export dynamic of starter batteries from Germany in natural indexes in 2016-2017, mln. pcs

15. Average export price dynamic of starter batteries from Germany in 2016-2017, $ per pcs

16. Dynamics of exports in terms of countries of destination in natural indexes in 2016-2017, %

17. Import dynamic of starter batteries from Germany in natural indexes in 2016-2017, mln. pcs

18. Average import price dynamic of starter batteries from Germany in 2016-2017, $ per pcs

19. Import geography in natural indexes in 2016-2017, %

20. Quantity offers structured of the different capacity batteries in Germany

21. Starter battery retail price dynamic in 2016-2017, $ per pcs

22. Factors, affecting the formation prices on the German starter batteries market

23. Auto parts distribution system

24. Main sale ways on the starter battery market

25. Forecast of the starter batteries market in Germany in 2018-2020 in money indexes via multifactor model, $ mln.

26. Forecast of the starter batteries market in Germany in 2018-2020 in natural indexes via multifactor model, mln. pcs

27. Forecast of the starter batteries market in Germany in 2018-2020 in money indexes via extrapolation method, $ mln.

28. Forecast of the starter batteries market in Germany in 2018-2020 in natural indexes via extrapolation method, mln. pcs