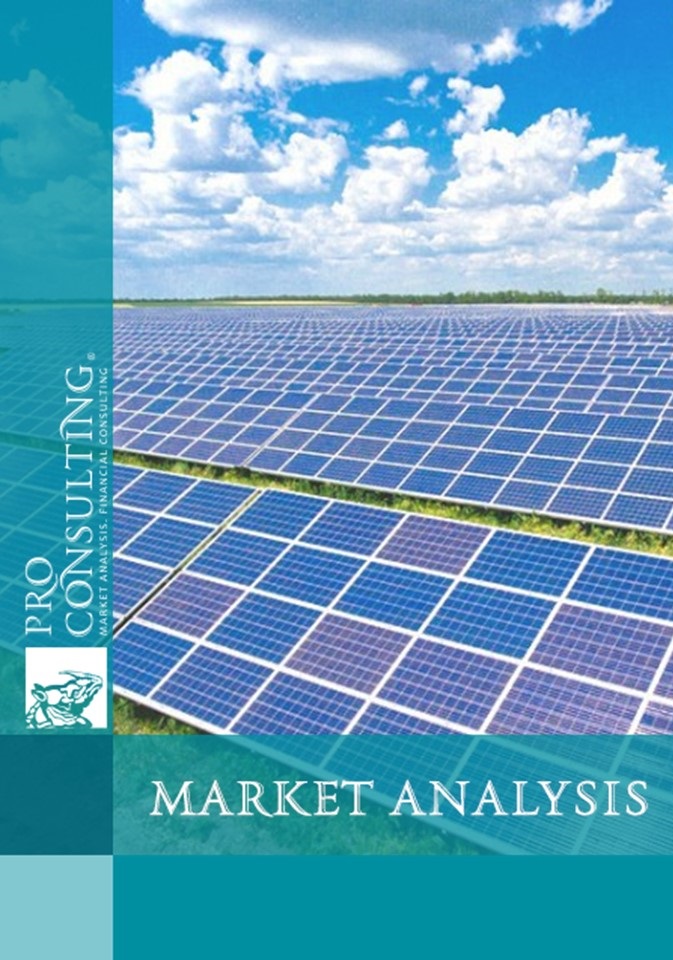

Market Research Report on Solar Energy in Gulf region. 2022 year

| Date of Preparation: | July 2022 year |

| Number of pages: | 45, Arial, 1 interval, 10 pt |

| Graphs and charts: | 5 |

| Tables: | 24 |

| Payment method: | prepayment |

| Production method: | e-mail or courier electronically or in printed form |

| Report language: | ukrainian, russian, english |

- This report can be updated and customized based on your business goals; you can also purchase part of report (no less than 50%) at a more affordable price

- Failed to find your market research report? - contact us

- You can also order feasibility study and business plan for your business idea

Detailed contents:

1. Gulf countries

1.1 United Arab Emirates

1.2 Saudi Arabia (KSA)

1.3 Oman

1.4 Qatar

1.5 Kuwait

1.6 Bahrain

1.7 Comparison of performance trends in Gulf countries

4. Conclusions. Forecast indicators

4.1. Conclusions and Forecast Trends in the Development of the Private SPP Market in the Countries Under Study

4.2. Construction of market development hypotheses. Forecast indicators of market development in 2022-2026 (in general in terms of capacity and development of the industry as a whole) by country

5. Investment attractiveness of the industry

5.1. SWOT analysis of the market direction

List of Tables:

1. Investments in SES projects in the UAE

2. Capacity of SPP projects in the UAE

3. Prices for electricity produced by solar power plants in the UAE

4. The main operators of the UAE solar energy market and their characteristics

5. Representation of companies by country and main projects, shares in projects

6. The roles of the main participants in the implementation of the project

7. Investment in solar projects in Saudi Arabia

8. Power projects in Saudi Arabia

9. Prices for electricity produced by solar power plants in Saudi Arabia

10. The main operators of the solar energy market in Saudi Arabia and their characteristics

11. Representation of companies by country and main projects, shares in projects

12. Investment in SPP projects in Oman

13. Capacity of SPP projects in Oman

14. Prices for electricity produced by solar power plants in Oman

15. The main operators of the solar energy market in Oman and their characteristics

16. The share of participation of companies in the Ibri 2 project

17. Investment in SPP projects in Qatar

18. Capacity of SPP projects in Qatar

19. Prices for electricity produced by solar power plants in Qatar

20. The main operators of the solar energy market in Qatar and their characteristics

21. The share of participation of companies in the Al Kharsaah project

22. The main operators of the solar energy market in Kuwait and their characteristics

23. The main operators of the solar energy market in Bahrain and their characteristics

24. SWOT analysis of the market direction (recommended Gulf countries - UAE, KSA, Oman)

List of graphs and charts:

1. Capacity structure of installed RES stations in the world

2. The ratio of private and public solar power capacities in the UAE, GW

3. The share of companies in the installed capacity of photovoltaic solar power plants in Bahrain

4. Dynamics of changes in indicators by countries (Gulf region), MW

5. Forecast indicators of the solar energy market in 2022 - 2026